How Eb5 Investment Immigration can Save You Time, Stress, and Money.

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

Blog Article

Eb5 Investment Immigration for Dummies

Table of ContentsSee This Report about Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.Not known Details About Eb5 Investment Immigration All About Eb5 Investment ImmigrationEb5 Investment Immigration - An Overview

While we strive to provide accurate and updated material, it needs to not be taken into consideration lawful advice. Immigration regulations and guidelines go through change, and specific circumstances can differ commonly. For customized guidance and lawful recommendations regarding your particular migration situation, we strongly advise consulting with a qualified migration lawyer that can provide you with customized aid and make sure compliance with present laws and regulations.

Citizenship, via financial investment. Presently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Employment Locations and Country Locations) and $1,050,000 in other places (non-TEA areas). Congress has approved these quantities for the next five years starting March 15, 2022.

To certify for the EB-5 Visa, Capitalists have to develop 10 full time U.S. tasks within two years from the date of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Demand makes certain that financial investments add straight to the united state work market. This applies whether the work are created directly by the business or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

The Best Guide To Eb5 Investment Immigration

These jobs are identified with versions that utilize inputs such as advancement costs (e.g., building and construction and devices costs) or yearly incomes created by recurring operations. In comparison, under the standalone, or straight, EB-5 Program, only direct, full-time W-2 employee settings within the company may be counted. A vital risk of relying solely on direct employees is that personnel decreases because of market conditions might lead to inadequate permanent placements, potentially leading to USCIS denial of the financier's request if the task creation requirement is not satisfied.

The financial version then forecasts the variety of direct tasks the new company is most likely to create based upon its expected profits. Indirect jobs computed with economic versions refers to work created in industries that provide the products or solutions to business straight associated with the job. These tasks are produced as an outcome of the boosted need for items, materials, or solutions that sustain business's procedures.

Some Known Questions About Eb5 Investment Immigration.

An employment-based 5th preference category (EB-5) financial investment visa provides an approach of coming to be a permanent U.S. citizen for foreign nationals wanting to spend capital in the USA. In order to get this environment-friendly card, a foreign financier needs to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Area") and create or preserve at the very least 10 full time work for USA workers (leaving out the investor and their prompt family).

Today, 95% of all EB-5 resources is raised and invested by Regional Centers. In many areas, EB-5 financial investments have actually loaded the funding void, supplying a new, important source of resources for neighborhood financial advancement tasks that rejuvenate neighborhoods, develop and support jobs, infrastructure, and solutions.

Excitement About Eb5 Investment Immigration

workers. Additionally, the Congressional Spending Plan Office (CBO) racked up the program as profits neutral, with administrative costs paid for by applicant charges. EB5 Investment Immigration. Greater than 25 countries, including Australia and the United Kingdom, usage similar programs to attract foreign investments. The American program is extra strict than numerous others, needing considerable risk for financiers in regards to both their monetary investment and migration condition.

Families and individuals who look for to relocate to the United States on a long-term basis can request the EB-5 Immigrant Financier Program. The USA Citizenship and Immigration Services (U.S.C.I.S.) set out various needs to get permanent residency with the EB-5 visa program. The needs can be summed up as: The published here financier must meet capital expense quantity needs; it is normally required to make either a $800,000 or $1,050,000 capital financial investment quantity right into a UNITED STATE

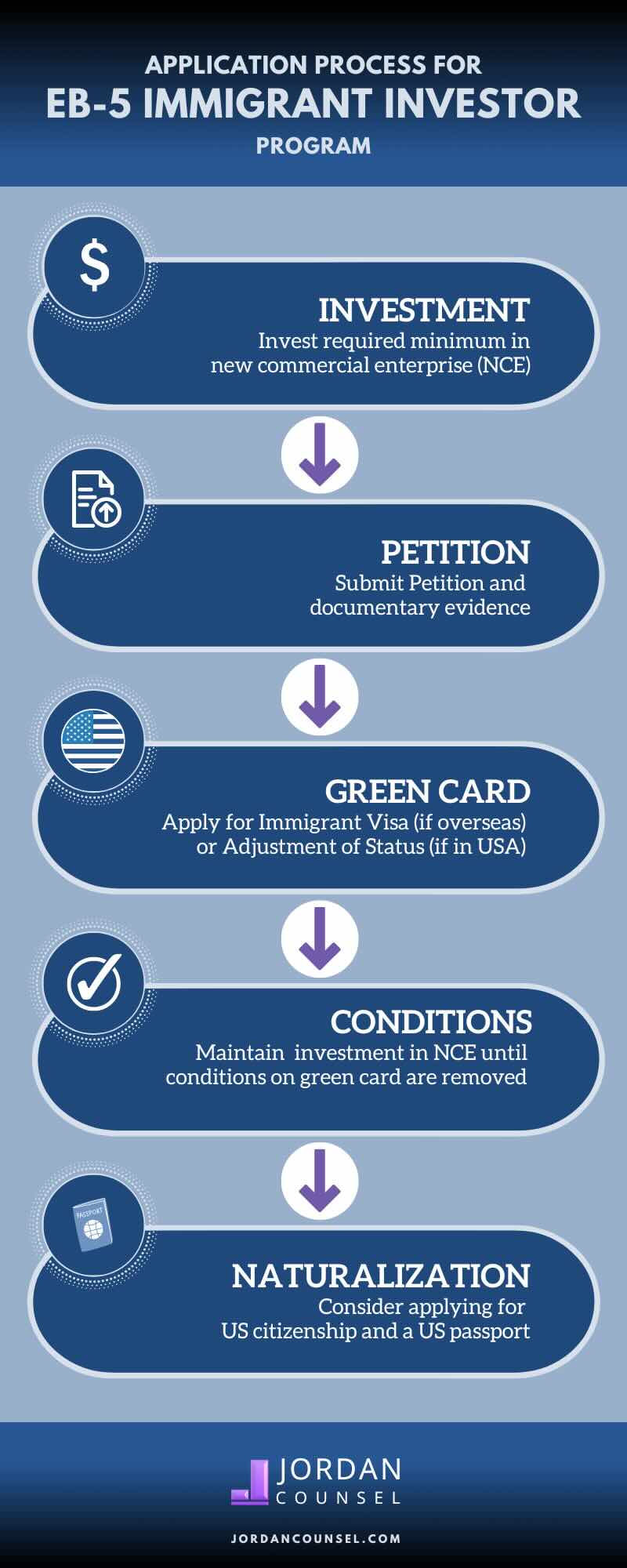

Talk to a Boston immigration lawyer regarding your needs. Below are the basic steps to acquiring an EB-5 financier permit: The primary step is to find a qualifying financial investment opportunity. This can be a brand-new business enterprise, a regional facility job, or an existing company that will certainly be broadened or reorganized.

When the opportunity has been recognized, the capitalist must make the financial investment and submit an I-526 request to the united state Citizenship and Immigration Provider (USCIS). This application wikipedia reference needs to consist of proof of the investment, such as bank statements, purchase agreements, and company plans. The USCIS will review the I-526 petition and either accept it or request added evidence.

Everything about Eb5 Investment Immigration

The capitalist needs to look for conditional residency by submitting an I-485 application. This request has to be sent within 6 months of the I-526 authorization and must include proof that the financial investment was made which it has actually created at least 10 permanent jobs for U.S. employees. The USCIS will certainly review the I-485 request and either accept it or request additional evidence.

Report this page